New Love: A Retirement Dream - or Nightmare?

The Surprising Downside of a Sunny Retirement

If your residency is changing, it may affect how you're taxed. Canada, for instance, has many residents that spend half the year in warmer parts of the U.S. "One of the issues there is when you're considered a resident of most countries in the world, you have to file taxes there," said Julia Chung. "We have a lot of Canadian residents who are just finding out that they're supposed to file a tax return with the U.S. every year."

When You Can't Afford Your House, Do this

If you’re in a cash flow bind, you don’t want to wait too long before you take action. But you should take some time to calculate the size of the problem. “A lot of times people don’t really look at their expenses,” said Julia Chung, a financial and estate planner with JYC Financial in South Surrey, British Columbia in Canada. “They have a hard time managing the numbers.”

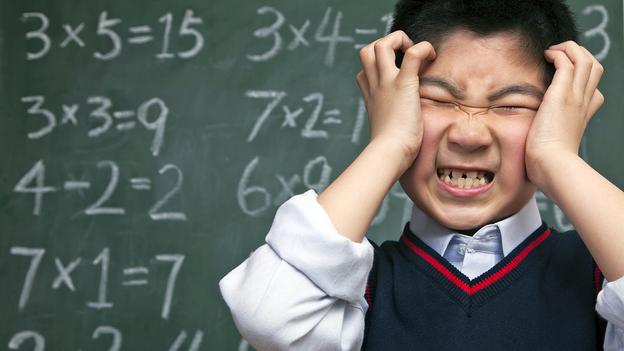

Why You Don't Want Your Child to Be a Genius

A Spender Marries a Saver - Now What?

Double the Trouble...

Caring for a Forever Child...

"These are things that are going to seriously affect your life and the lives of people after you," said Julia Chung, a financial and estate planner with JYC Financial. "Spend the money." You will likely need both a financial planner and a lawyer that specializes in estates, and possibly an accountant to review tax ramifications.